Consider this. It is often desirable to make a donation not using cash. If you are like so many others, your monetary resources may be tied up in non-cash assets. Financially speaking from a tax standpoint, you may be better giving something other than cash.

When you make charitable gifts to the UUSC with appreciated assets (assets you have held for over one year and that have grown in value), such as stock, bonds or mutual funds, you receive a double tax benefit. A charitable deduction is allowed for the current fair market value and the capital gain is not taxed, meaning in essence you receive a tax break for appreciation on which you never paid taxes. By using appreciated assets, the gift actually costs you less!

Another tax-wise alternative is to use your appreciated property to fund life income gifts such as annuities or charitable remainder trusts. You then receive income for those donations.

The chart below illustrates the tax benefits when using appreciated assets:

Cash Gift vs. Stock Gift

|

|

Cash Gift

|

Stock Gift

|

|

a. Gift Value

|

$10,000

|

$10,000

|

|

b. Income tax deduction

|

$10,000

|

$10,000

|

|

c. Income tax saved (at 37% rate)*

|

$3,700

|

$3,700

|

|

d. Purchase price

|

-

|

$1,000

|

|

e. Increase in value (a - d)

|

-

|

$9,000

|

|

f. Tax avoided on gain (at 20% rate)

|

-

|

$1,800

|

|

g. Total tax savings (c + f)*

|

$3,700

|

$5,500

|

Most gifts of stock can be made easily via electronic transfer. Even if you like your investments, you can give your appreciated shares and use cash to replace them with shares with a higher cost basis.

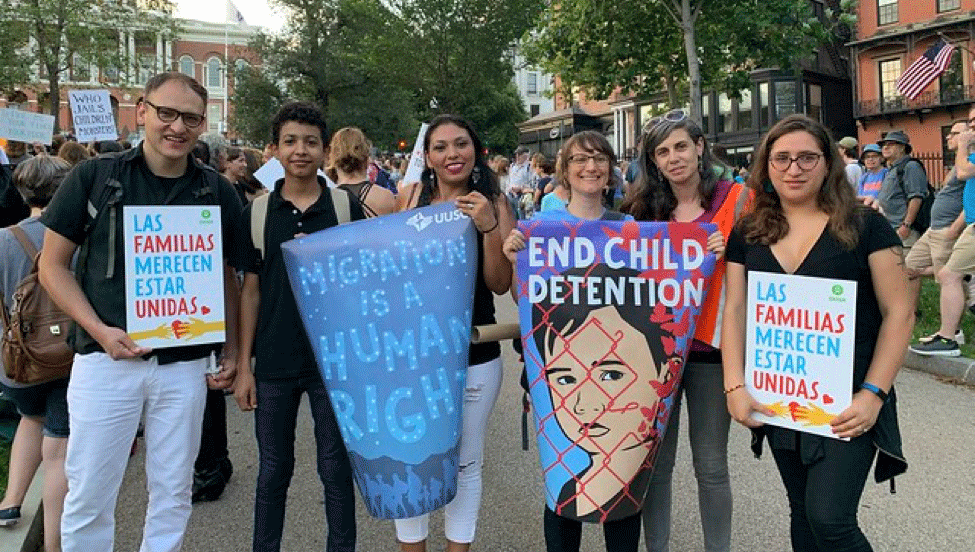

By using your appreciated securities, you can make a tax-wise donation while also helping UUSC continue delivering on our promise to address the root causes of injustice and promote world-wide human rights.