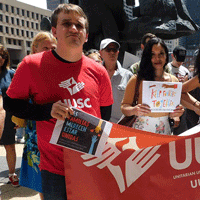

Planned giving is a great way to support UUSC while generating income for yourself and your family. Learn how these gifts allow you to achieve both of these goals.

Charitable Gift Annuity

A charitable gift annuity provides fixed payments to you or others you name for life in exchange for your gift of cash or securities.

Deferred Charitable Gift Annuity

A deferred gift annuity provides fixed payments to you or others you name for life in exchange for your gift of cash or securities. The payments start on a date you choose that is at least one year after you make the gift.

Charitable Remainder Trust

A charitable remainder unitrust can help you maintain or increase your income while making a significant gift to Unitarian Universalist Service Committee. The charitable remainder unitrust is highly flexible. You can easily make gifts of assets that are not easily converted to cash using the unitrust. If your unitrust grows, your payments will grow too, providing a potential hedge against inflation.

The IRA Charitable Rollover Gift Annuity Plan

You can now make a Qualified Charitable Distribution in exchange for a charitable gift annuity and receive fixed income for life.